Rethinking Delivery For AI (Part 1)

The foundational promises of SaaS - scalability, defensibility, operating leverage - are growing harder to realize, and unravel further with AI.

The cloud platform shift enabled the rise of Software-as-a-Service (SaaS), and with it, a new way to deliver and consume enterprise software.

SaaS upended the old model characterized by hefty upfront implementation fees and ongoing maintenance charges, with subscription-based access. It also minimized the need for customers to manage hardware and IT services, which typically accounted for 70-85% of the total cost of ownership (TCO), by effectively outsourcing the infrastructure to hyperscalers. TCO is reduced, while SaaS vendors capture a larger share of it.

SaaS also expanded the market for software. By eliminating prohibitive setup costs and enabling self-service models, it lowered adoption barriers for smaller organizations.

The standard thesis on why SaaS is attractive looks something like this:

Secular growth tailwinds from digitization and cloud migration

High gross margins from low marginal cost to serve

Defensibility via high switching costs

Operating leverage after upfront S&M and R&D investment

We’re now amid a new platform shift: generative AI. While building my SaaS startup, where we embedded GenAI capabilities in the product, my experience was that AI causes some long-held assumptions to unravel.

But first let’s revisit the classic SaaS thesis.

A Closer Look at the SaaS Reality

To assess how the classic SaaS narrative has played out, I looked at the financials of three category leaders: Atlassian, Datadog, and CrowdStrike. All three are high-growth B2B SaaS firms with strong market positions:

Atlassian builds developer collaboration tools like Jira and Confluence.

Datadog offers observability solutions for cloud infrastructure.

CrowdStrike secures enterprise endpoints and identities.

Growth? Still impressive.

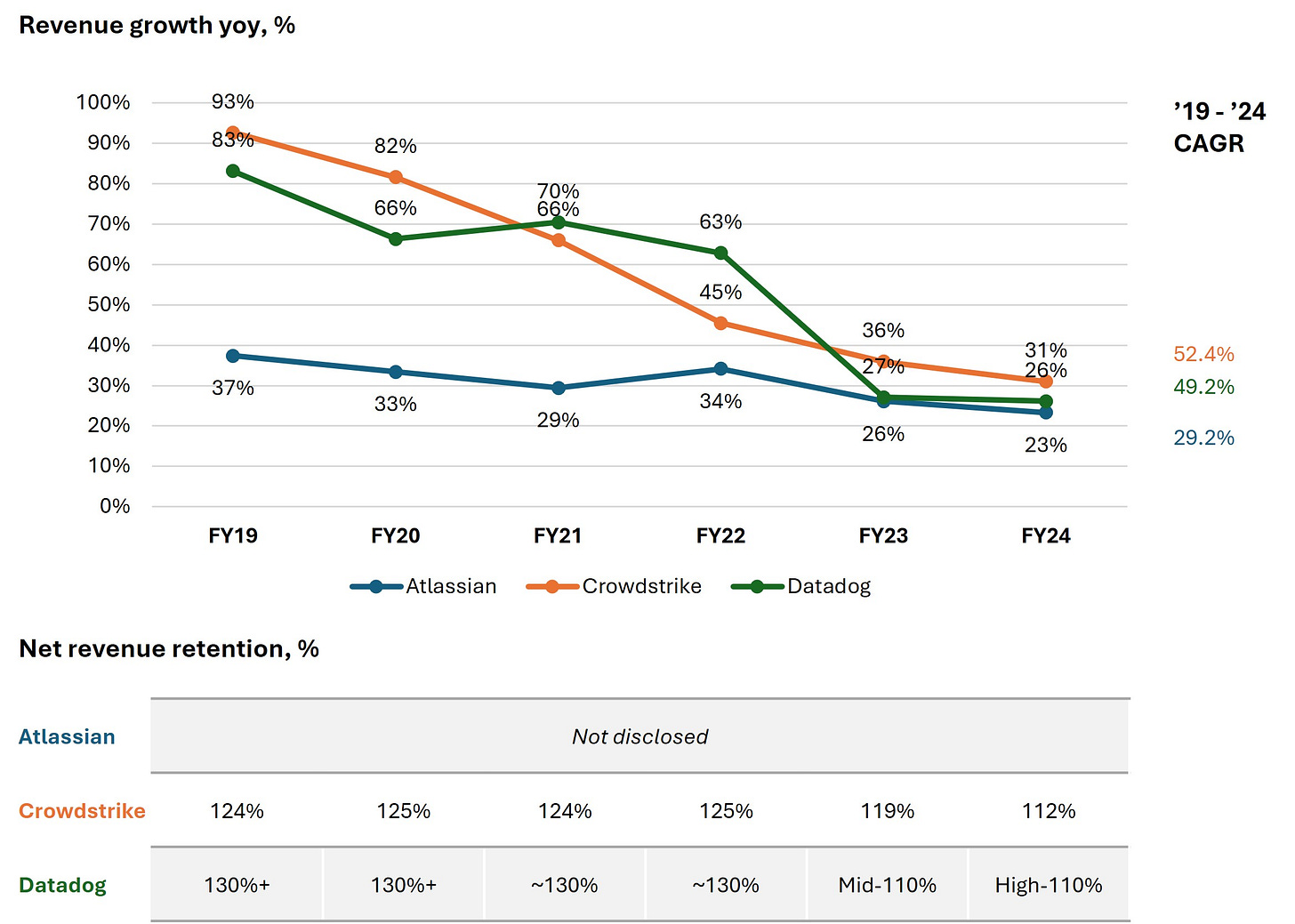

Over the past five years, these companies have delivered strong revenue compound annual growth rates: 29% for Atlassian, 49% for Datadog, and 52% for CrowdStrike.

This growth has been helped by expansion of revenue from existing customers. Net revenue retention (NRR) measures the expansion (or contraction) in revenue from the in-force customer base during the period. This remains above 100% for Datadog and CrowdStrike, indicating successful land-and-expand motions. For Datadog, ~55–65% of recent growth has come from existing customers.

Yet there are signs of deceleration. Slowing growth suggests early-adopter customer segments are now saturating, with incremental sales becoming harder. As market penetration gains slow, continued wallet share gains with existing customers has been crucial to sustain growth.

Client defensibility is a key tenet of the SaaS growth story, especially at scale. It is thus notable that net revenue retention is showing signs of slipping.

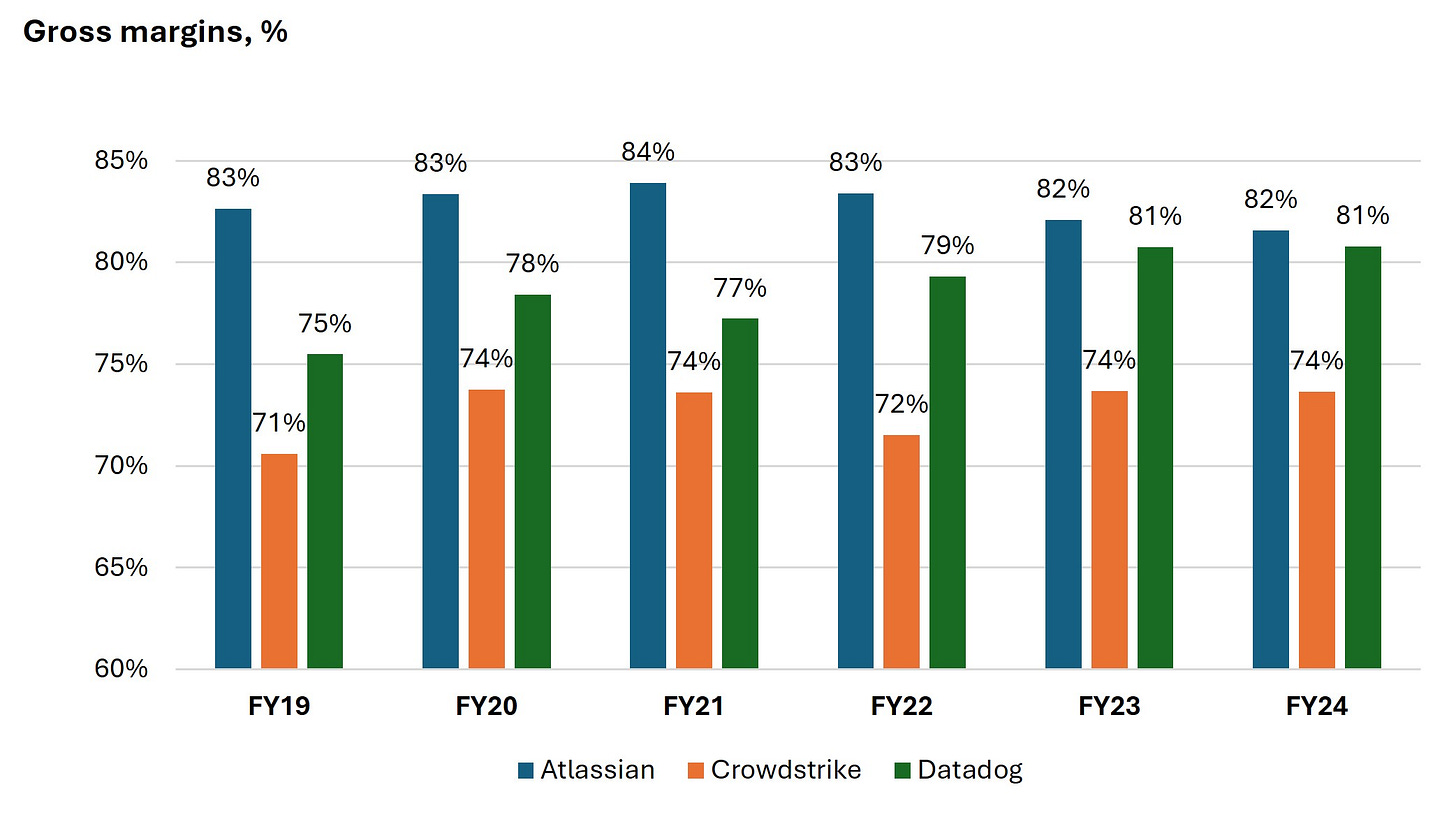

Gross margins? Holding up

Each of the trio consistently posts gross margins between 70–85%. At Datadog specifically, gross margins have in fact improved over time, due to lower marginal cloud infrastructure costs. So far, SaaS has resisted pricing commoditization pressure that might threaten these margins.

Profitability? Mixed

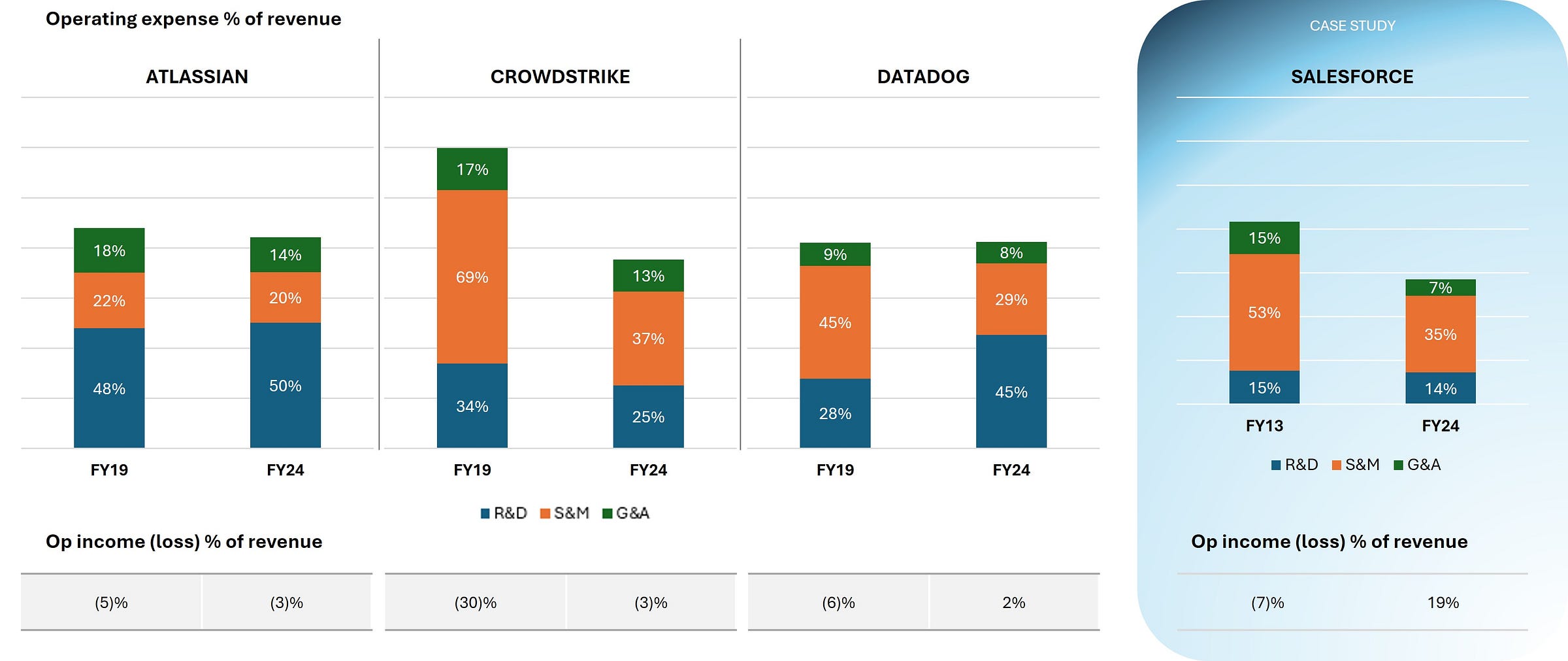

Atlassian and Crowdstrike operate at a GAAP loss. While Datadog barely achieved operating profits in its most recent financial year, after consistent losses. Across the board, operating losses have narrowed in recent years, which provides some support for operating leverage. However, the jury remains out on whether sustaining profitability is possible.

The real drag: R&D

This trio exemplify the operating expense challenge of SaaS. Even at scale, they continue to have to invest heavily in sales and marketing (S&M) and research and development (R&D). General and administrative (G&A) is a meaningfully smaller cost driver.

Salesforce, as the pioneer of SaaS, demonstrates the potential path to profitability. In FY13, Salesforce was similar in scale to our trio. Between then and now, they went from a 7% operating loss to a 19% operating profit as revenue growth significantly outpaced S&M and G&A expenses.

Salesforce spends 35% of revenue on S&M at ~10x the scale, which suggests the trio has limited headroom to drive leverage here. Especially as sales efficiency declined, even though existing customers increasingly contribute significantly to growth.

That leaves R&D. Why do this trio spend so much more on R&D relative to Salesforce? Competitive intensity and the challenge of building durable moats are central to the answer.

Salesforce launched in 1999 into a landscape of legacy on-prem players like Siebel and Goldmine. Its cloud-native approach was dismissed by incumbents, giving it time to build a lead among SMBs before expanding to enterprise. That head start allowed Salesforce to construct a deeply entrenched ecosystem:

Expansive reseller and SI network to drive adoption

Certification programs that became industry standards

A marketplace of integrated third-party apps

M&A-led expansion into adjacent workflows, enhancing stickiness

In contrast, our trio launched in much more competitive environments:

Atlassian entered with a narrow collaboration toolset, but faced adjacent competition from developer tools like GitHub that captured core parts of the workflow. As the market matured, collaboration software became increasingly fragmented and competitive.

Datadog targeted a nascent but contested space in cloud monitoring, with incumbents like Splunk and New Relic, and strong open-source alternatives like Prometheus and Grafana. As customers scaled, the open-source option became even more attractive. Coinbase, for instance, nearly switched to this stack, ultimately renegotiating Datadog pricing from ~$65M to ~$10M annually.

CrowdStrike plays in the intensely competitive cybersecurity market, where "best of breed" is often a must. To land and expand, CrowdStrike must match pure-play competitors in every threat category, and the threat landscape evolves fast.

Despite this, all three have executed exceptionally well. They’ve grown into market leaders and continue to invest both organically and inorganically to build broader platforms. But unlike Salesforce, they’ve had little room to consolidate their market positions. They must continue spending heavily to defend their positions.

The broader point: Salesforce’s trajectory is the exception, not the rule. When deep moats are elusive, SaaS firms must rely on constant product innovation to stay ahead. That innovation is expensive, and its advantage is short-lived.

A closer look at our trio’s cost structures suggests that one of the core pillars of the SaaS model, operating leverage through category leadership, isn’t a given. The execution bar to earn it is exceptionally high.

AI changes the game again

AI promises a new wave of growth. It can unlock end-to-end automation in sectors previously hard to digitize. But while the opportunity is enormous, it also disrupts the already-tenuous SaaS model.

Inference pressures gross margin

With SaaS, the marginal cost of serving another user is nearly zero. But in AI-native products, every API call incurs inference costs

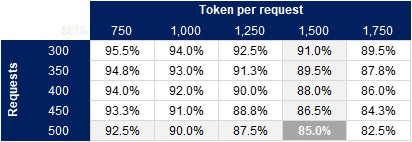

Cursor (an AI-powered IDE) illustrates this. Their base pricing is $20 / month for 500 fast requests and unlimited slow requests. If we assume each fast request uses an average of 1,500 tokens (1,000 input, 500 output) and base our LLM costs on prevailing gpt-4.1 API pricing, that implies a margin of 85%. This implies a gross margin of 55-65% once we account for other typical SaaS cost of revenues that likely apply here too.

This margin assumption is highly sensitive to the actual utilization of users, as we can see in this sensitivity table here that stresses our utilization and token per request inputs.

For complex tasks, Cursor offers a “max mode” which charges a 20% markup on top of the underlying LLM API cost, which suggests a significantly lower margin of 17%.

This is a structural challenge. While inference costs may decline over time, today’s AI-native apps are launching with 20–50% lower gross margins than traditional SaaS.

Support costs increase

AI is probabilistic and prone to error. Foundational model improvements such as inference-time reasoning architectures help performance. Nonetheless, to deliver the accuracy and reliability required in enterprise settings, other methods like prompt optimization, ongoing evaluation and model fine-tuning are required. This means increased support needs.

With outcome-based pricing becoming more common, vendors may not be able to pass on these costs since support may be presumed. This will further dilute gross margins.

Switching costs will fall

Historically, being embedded in a customer’s tech stack created strong moats. Integrations were hard to unwind. As I wrote in my previous article, AI may be starting to unwind this dynamic.

AI accelerates the pace of building integrations between software. It also makes it more feasible to bridge legacy systems, even those without APIs. Meanwhile, Model Context Protocol could make software more composable by providing AI agents with a standardized method to reason over, select and use external software. As a result, the friction traditionally associated with switching vendors may start to meaningfully decline.

Competitive pressure drives up R&D and S&M

AI has lowered the barrier to start software companies, leading to a flood of competition. This is already evident in horizontal categories like sales, customer support, and software development. New entrants compete on features and speed, forcing incumbents to keep up through aggressive R&D.

At the same time, AI raises customer expectations. Sales processes must be smarter. Product demos must showcase AI. Engineering teams must deliver faster. Even incumbents with large installed bases are spending heavily to embed AI across their platforms.

Yes, AI might boost productivity – autonomous sales development reps, faster coding – but if everyone benefits equally, the bar just gets raised. AI doesn't guarantee better margins; it might just reset expectations higher.

Closing thoughts

SaaS hasn’t failed. On many accounts, it has delivered. However, it has fallen short in demonstrating that the model has sufficient inherent operating leverage to drive sustainable profitability.

AI likely rewrites the thesis completely. It creates new growth opportunities but challenges the defensibility of installed customer bases. It compresses gross margins, which further threatens the tenuous economics of the business model. Intensifying competition means the need for continued high R&D investment is unlikely to go away any time soon.

I believe in AI. But I’m less sure that SaaS is the best model to deliver it.

The more I think about it, the more it seems that services may be a more natural fit for how AI creates value. I’ll explore that hypothesis in my next article.

I muse on how AI impacts problem areas that are personal or that interest me in a series of articles. I hope it sparks learning and conversations with likeminded folk.